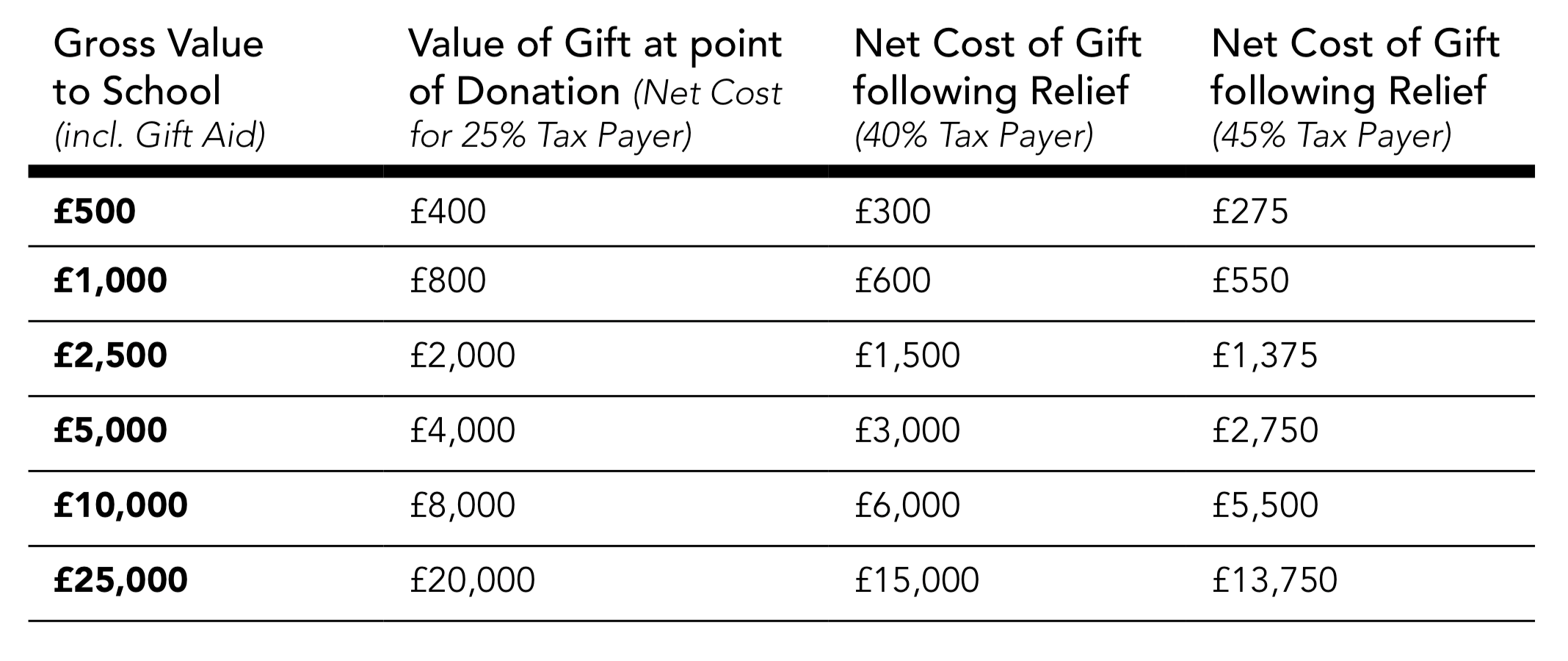

Gifts from UK tax payers are eligible for Gift Aid. Higher rate tax payers can reclaim tax against their giving, as illustrated below. Please contact the RBAI Foundation Director for further information.

INTERNATIONAL DONORS

Donors in the USA can give tax efficiently via the British Schools and Universities Foundation (www.bsuf.org), ensuring they receive a 501c receipt, whilst 100% of the gift reaches RBAI.

Donors in other countries should contact the RBAI Foundation Director to discussed tax-efficient contributions.

DONATING SHARES OR OTHER ASSETS

RBAI can accept gifts of shares or assets including land. Such gifts from UK tax payers will be exempt from Capital Gains Tax, whilst the donor can also claim Income Tax relief on the market value of qualifying shares at the point of gift.

By way of example, a 45% taxpayer gifts shares worth £10,000 to RBAI, which they purchased for £6,000. Alongside saving 20% capital gains tax on the profit of £4,000, they can claim 45% tax relief on the total gift. This equates to a total tax saving of £5,300, meaning the net cost of the gift to the donor is £4,700. Source: Charities Aid Foundation